Having a profitable and smooth exit strategy is paramount for any business owner facing retirement or a business sale. But independent pharmacy owners also can avoid selling out to the big chains, in favor of keeping the business they built strong and independent.

“…every graduating pharmacist with an entrepreneurial interest represents a future independent pharmacy owner.”

If retirement is in your foreseeable future, you’re not alone. More than 37 percent of pharmacists were 55 or older in 2014. Implementing a succession plan several years before retirement comes can put all the financial and operational processes in place to ensure a seamless transition.

It’s one reason that Western States Pharmacy Coalition (WSPC) offers succession-planning resources. WSPC cares deeply about helping its members make sound decisions about the future of their pharmacies. WSPC offers reputable resources such as banks, specialized business consultants and others interested in working with independent pharmacies.

“The appeal of independent pharmacies is growing,” observed Peg O’Neil, pharmacy ownership consultant for AmerisourceBergen. “Many chain pharmacies are no longer offering graduates the same lucrative salaries and signing bonuses as they were just five years ago. Therefore, every graduating pharmacist with an entrepreneurial interest represents a future independent pharmacy owner.”

Selling doesn’t mean selling out

According to O’Neil, too often, pharmacy owners feel like the only path for an exit is to accept an offer to sell their prescription files to a major chain, instead of first trying to sell their pharmacy whole to another independent owner.

Independent pharmacies are important community institutions.

Independent pharmacies enjoy long-established, personable patient relationships.

Independent pharmacies nurture loyal employees.

An independent pharmacy is a sound investment for a new owner, who can count on a predictable level of operating income.

“It’s never too soon to start that process, especially if you know that you’ll want to sell to an independent owner,” explained Jerry Van Pevenage, a retired, former independent pharmacy owner. “It could take three-to-10 years to find the right buyer. So the time to start is now. Pharmacy schools aren’t directing a lot of their students in the direction of independent ownership, so it can take time to find the right person. I went through three potential buyers for my pharmacy, so it is a process.”

However, the pool of potential independent buyers is growing every year. Not only did the total number of practicing pharmacists in the U.S. increase by about 19 percent from 2003 to 2014, the number of professional student pharmacist enrollments also is increasing.

Premier lending options

Plus, there are lending institutions jumping on this special, small-business niche. For example, Live Oak Bank is a Small Business Administration-approved lending institution that specializes in loans to purchase community pharmacies. It boasts fast closings (45 days) and customized loans designed for pharmacy purchases. Live Oak Bank also helps owners of independent pharmacies expand their businesses by purchasing prescription files. Buying prescription files historically has been a chain strategy, but it’s available to independents as well.

Testimonial

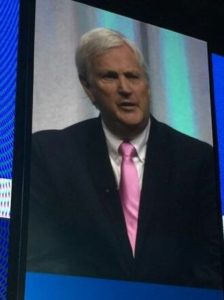

John Bruce, Pharm D on stage at AmerisourceBergen’s ThoughtSpot General Session

“In June this year, I culminated my 43-year career as owner of Cal-Med Pharmacy in Mission Viejo. I started my pharmacy at the age of 26, only three years after graduating from the University of Southern California School of Pharmacy. As the years passed by, our profession continued to grow, progress, and change. It was at age 66 that I began the process of thinking about life after pharmacy.

My goal was to sell to another independent pharmacist who was also an AmerisourceBergen customer. Through help from my business coaches, Dennis Witowski and Scott Welle, I began the selling process. They put me in contact with Charles LeBon, the ABC pharmacy ownership consultant. We established a price, and he brought me contacts of people who might be interested in buying my store.

After discussions, we created an agreement with the potential buyer. He was also a USC graduate, who graduated 32 years after me. We started doing the required obligations: landlord lease, State Board of Pharmacy license, bank financing, and agreeing on a timeline for making the sale public knowledge. We got all four of these to come together, and the sale became final the end of June this year.

There were certainly bumps along the way, but by having trust, belief, and friendship, the new owner and I were able to navigate through the challenges and complete a successful transaction.

Western States Pharmacy Coalition has a group of individuals with pharmacy ownership buying and selling experience. Speaking for myself, I would be glad to answer any questions you might have about my journey through my relationship as a Western States Pharmacy Coalition member.”

Find out more

To learn more about succession planning, and independent pharmacy purchasing and selling options, take a look at some of our succession-planning contacts who can provide business consultation and a wealth of resources from lenders.

Lending, Selling & Buying Resources:

“Live Oak Bank knows Pharmacy. Working with a lender that understands your industry allows us to smoothly and quickly tailor a loan package to meet your needs.”

https://www.liveoakbank.com/pharmacy-loans/

Jimmy Neil — 901-212-4951 or [email protected]

![]()

“Products and services for every state of your career – an easy pill to swallow. Loans may include: up to 100% financing, fixed rate terms up to 15 years.”

https://www.eastwestbank.com/PPS/Professionals-We-Serve/Pharmacists.aspx

888-818-8588

![]()

“First Financial Bank is here to help you with your Pharmacy financing needs. From store acquisitions to start-ups, construction to refinancing existing business debt. First Financial has competitive loan terms and services to meet your business needs.”

https://www.ffb1.com/pharmacy/pharmacy-loans.html

Drew Hegi — 601-594-6237 or [email protected]

Bo Garmon — 479-856-3001 or [email protected]

Pharmacy Consultants:

![]()

Charlie Le Bon – [email protected] – 949-212-1788 (west)

John Pross – [email protected] – 315-857-7574 (east)

Pharmacy Solutions

“Retail Pharmacy Consultants have expertise for the last two decades with servicing hundreds of retail pharmacies and are always available if you have questions regarding starting up your new retail pharmacy, mergers, partnerships, purchase contracts, escrow companies, buying, or selling of your pharmacy.”

View the flyer (pdf)

www.rxhelp911.com

Oleg Piller 818-261-5010